Broker-Dealer Compliance Solutions

Customized, Comprehensive, and Cost-Effective Consulting and Operational Solutions for Broker-Dealers.

ACA’s broker-dealer solutions are designed to assist your firm implement compliance and supervisory programs that align with Financial Industry Regulatory Authority (FINRA) and Securities and Exchange Commission (SEC) regulations.

Our team will guide you through business model decisions and design and support a wide array of programs to help ensure your firm’s broker-dealer regulatory and compliance obligations are fulfilled.

Our consultants have years of regulatory experience and professional designations, such as and Certified Anti-Money Laundering Specialists (CAMS) certifications.

Complete the form to learn why broker-dealers choose ACA consultants for their compliance program.

GRC Solutions for Broker-Dealer Compliance Programs

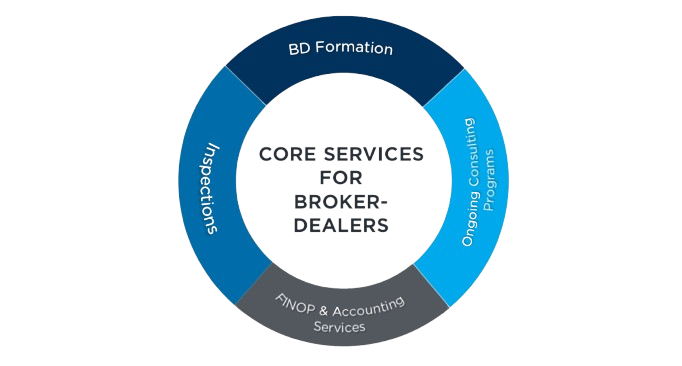

ACA’s broker-dealer division offers comprehensive compliance and supervisory programs aligned with FINRA and SEC regulations. Below are some of our compliance services for broker-dealers.

Broker-Dealer Platform

We offer a cost-effective program informed by your needs and our collective, recent regulatory experiences. Your dedicated consultant will guide you through business model decisions with practical solutions that consider regulatory expectations and the reality of running a business.

- Identify the specific lines of business and consequent regulatory requirements

- Draft required written supervisory procedures, AML policy, and other key operational

and compliance policies and procedures - Prepare the initial Form BD and FINRA’s New Membership Application (Form NMA)

- Complete state registrations for your broker-dealer and its registered persons

- Coordinate a comprehensive approach to the submission and follow up with FINRA to present the firm in the best possible light

Breadth and depth of experience – Our team approach to consulting provides a dedicated consultant and backup while leveraging the knowledge of other experts in our organization, providing both an institutional and intimate understanding of your firm and its regulatory requirements.

Outsourced CCO – For certain firms, this model can provide an experienced CCO with a position of authority within the firm. We will work with you to determine if this option is ideal.

Outsourced Financial and Operations Principals (FINOPs) and professional accounting services to keep your firm in compliance. Our consultants are licensed series 27 and series 28 professionals that have years of financial experience.

- Anti-Money Laundering (AML) Audit (FINRA Rule 3310) - Independent auditor to conduct a required test of the firm’s AML program.

- Policies and Procedures Testing (FINRA Rule 3120) - A risk-based review that tests and verifies the firm’s written supervisory procedures.

- Main OSJ Office Inspection (FINRA Rule 3110) - We will assist in the required annual internal exam of the firm’s business practices and books and records.

- Branch Inspections (FINRA Rule 3110) - We will travel to inspect the firm’s offsite OSJ, branch and non-branch locations.

Why ACA?

Our team includes former SEC, FINRA, and state regulators along with former Chief Compliance Officers and senior compliance managers from prominent financial institutions in the industry. We offer a deep understanding of the regulatory landscape and the holistic use of technology to maximize efficiencies and provide true value.

With ACA, you can feel confident knowing that your broker dealer compliance consultants have the relevant and current regulatory and in-house expertise to support you through every step of the process.

Complete the form to learn why broker-dealers choose ACA for their compliance program.

-1.png)